The Biden administration launched a new beta website for its income driven repayment program called SAVE that was announced after the Supreme Court struck down its student loan forgiveness plan. The site will accept applications which take about 10 minutes to complete.

According to the Education Department, the new plan will help the typical borrower save more than $1,000 per year on payments, allow many borrowers to make $0 monthly payments, and ensure borrowers don’t see their balances grow from unpaid interest.

The plan caps the required payment amount for undergraduate loans at 5% of a borrower’s discretionary income. It also raises the amount of income considered non-discretionary so people making the equivalent of $15 an hour won’t have to make a payment.

Here’s how it’s done:

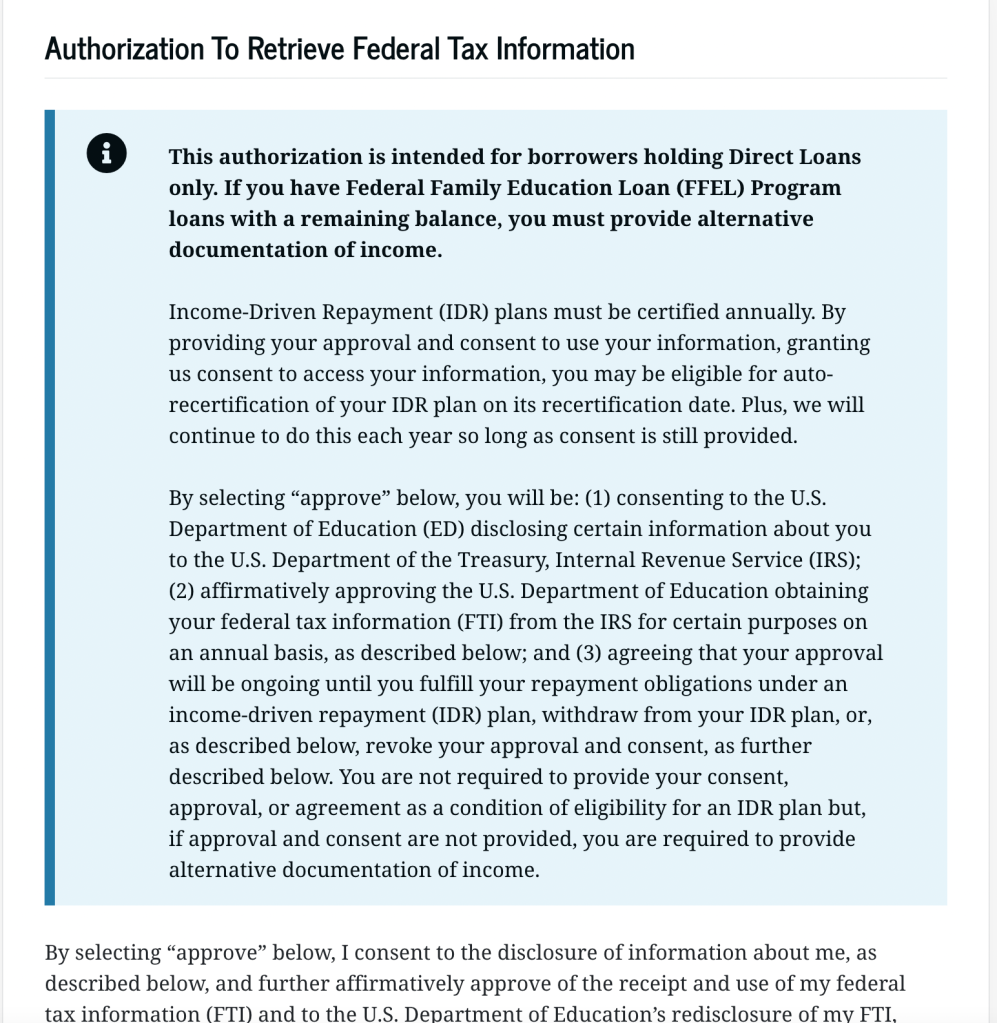

Step one

Authorize the Department of Education to retrieve your federal tax documents. As the application states: “You are required to provide income information to determine your eligibility.”

Providing approval allows the department to certify your income and recertify it every year to ensure the you still qualify. If you do not approve, you will have to submit all the documents yourself and then resubmit year after year to recertify.

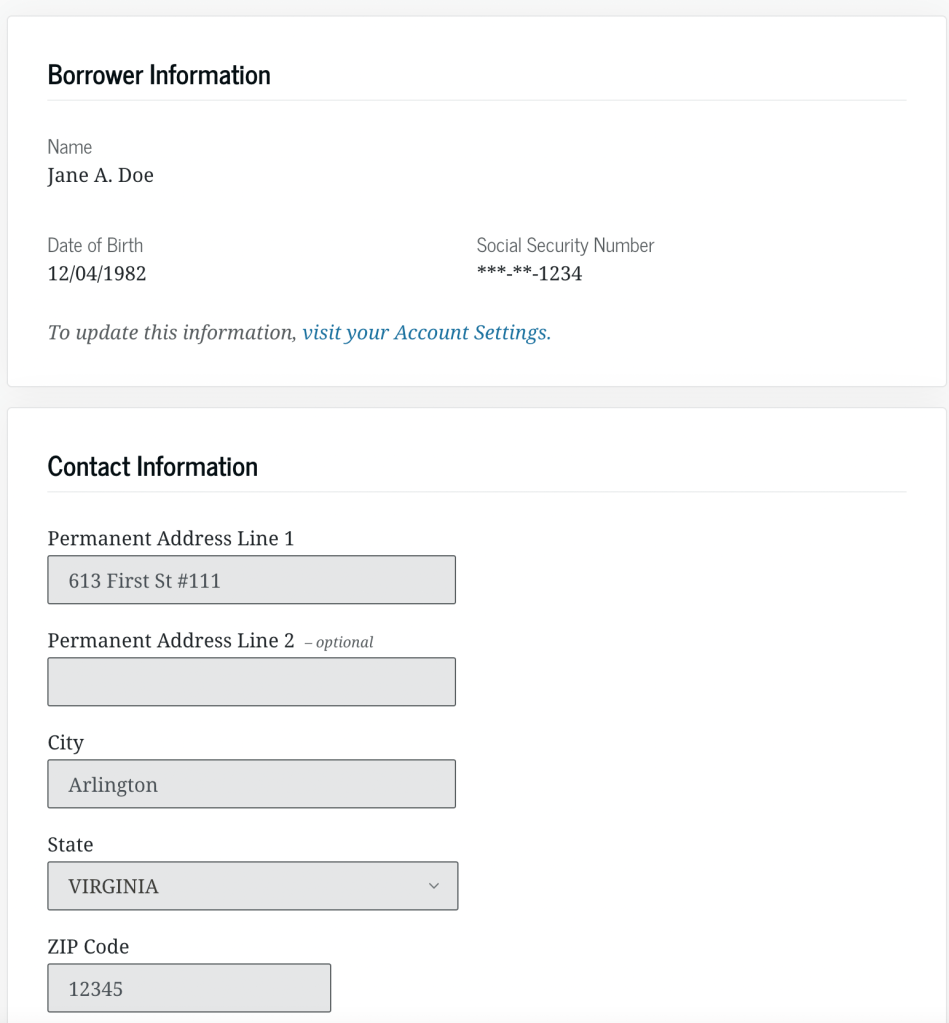

Step two

Enter your name, date of birth, Social Security number and contact information then answer a few questions regarding marital and family status.

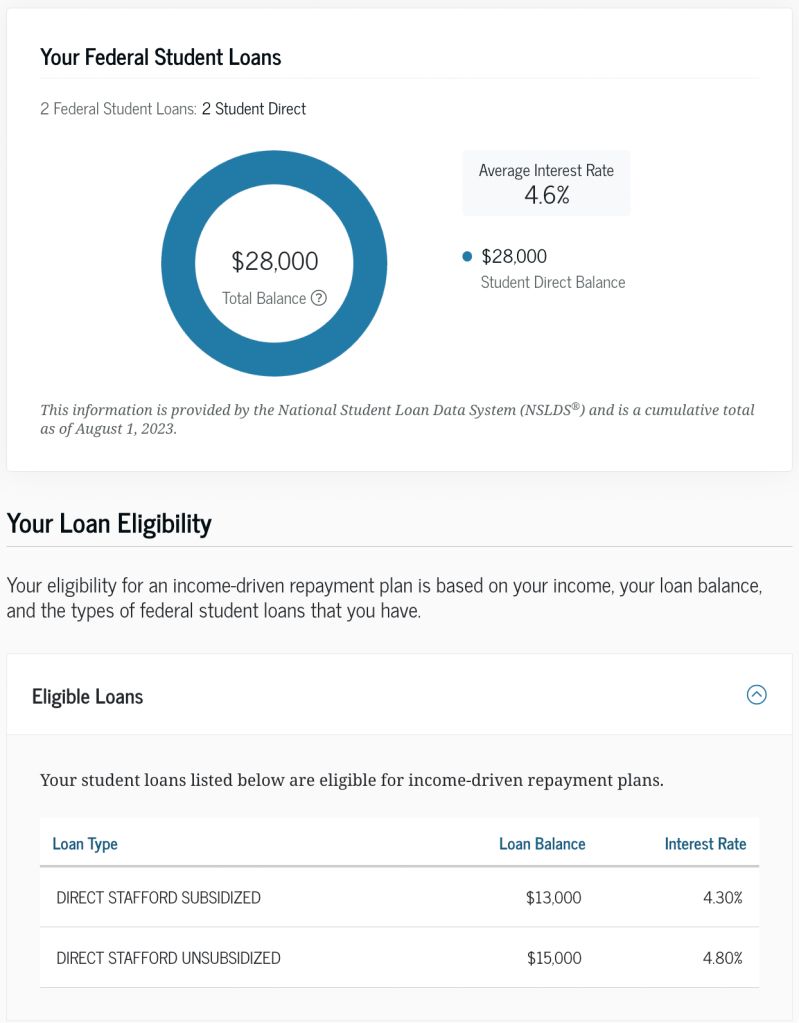

Step three

Review your loans eligibility.

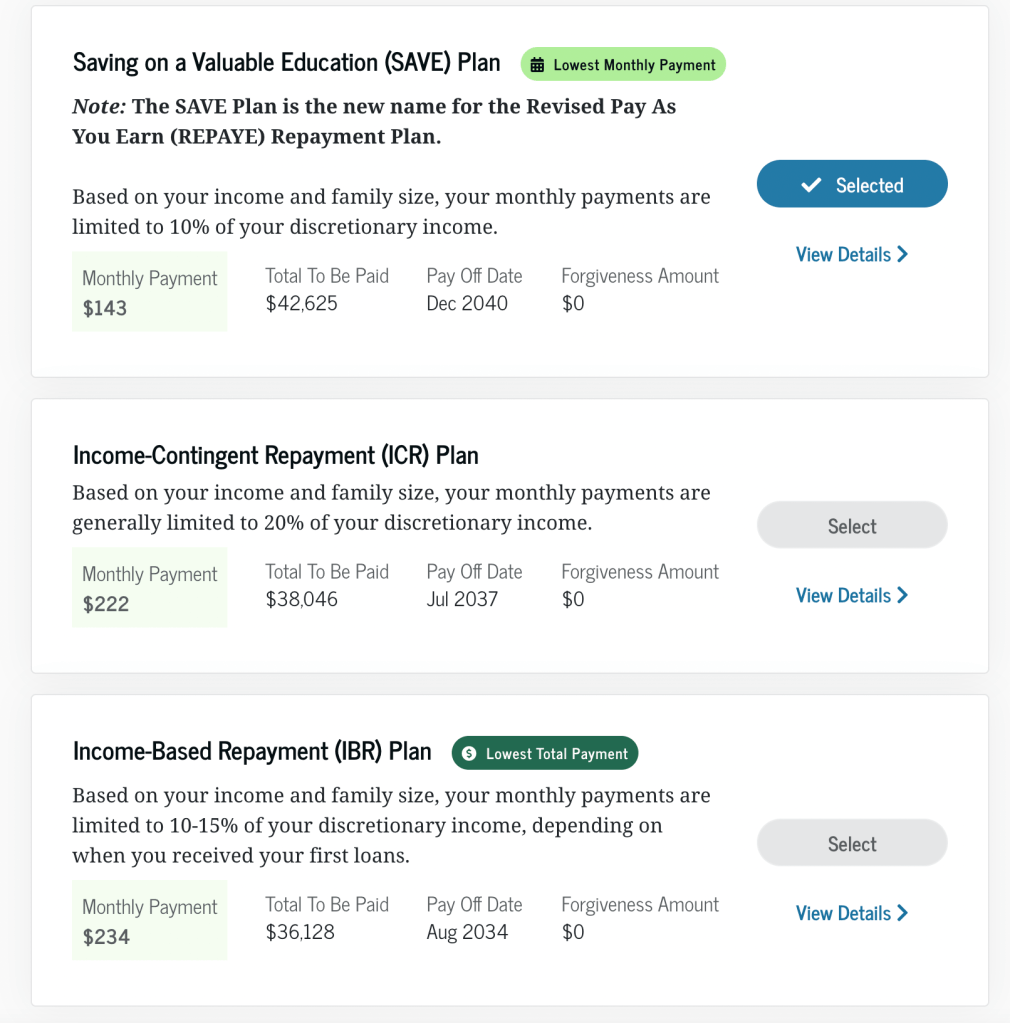

Later in the process, borrowers can estimate their monthly payments and choose from different payment plans.

Some payment plan options offer lower monthly payments for longer payoffs and ultimately a higher price tag. Other plans let borrowers pay more per month but less overall with a shorter payoff period.

There are separate processes for people hoping to begin an income-driven repayment plan for the first time and those already on an IDR plan.

Visit studentaid.gov/idr to fill out an application.