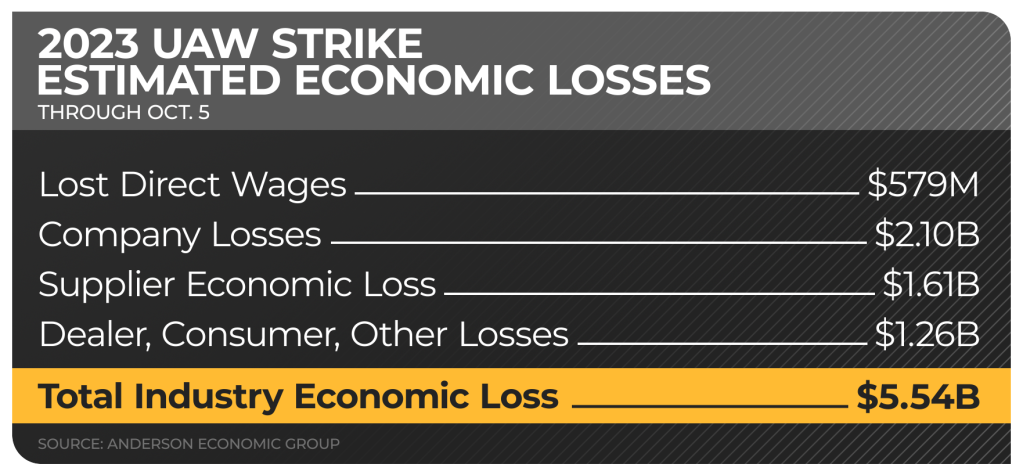

Update on Monday at 12:55 p.m. Eastern: The ongoing United Auto Workers strike has set a current-century record for losses due to an auto industry strike. Anderson Economic Group announced Monday that through Oct. 5, total economic losses from the strike exceeded $5.5 billion. The previous record loss was $4 billion from the 2019 UAW strike against GM.

United Auto Workers (UAW) has held the line against Ford, General Motors and Stellantis for three complete weeks. Now, there are whispers of progress at the bargaining table, as both sides lose hundreds of millions each week the strike goes on.

“It’s kind of hard now,” said Roy Wood, a UAW worker striking against Ford in Chicago. “We’re just in our first week for me, and we’re just waiting for this to come to a conclusion, hopefully fast.”

Striking workers are living off $500 per week from the strike fund while fighting for higher pay in the plants.

“You cannot ignore the fact that there is an economic loss being incurred every day while the strike is still going,” said Shay Manawar, a senior analyst at Anderson Economic Group (AEG).

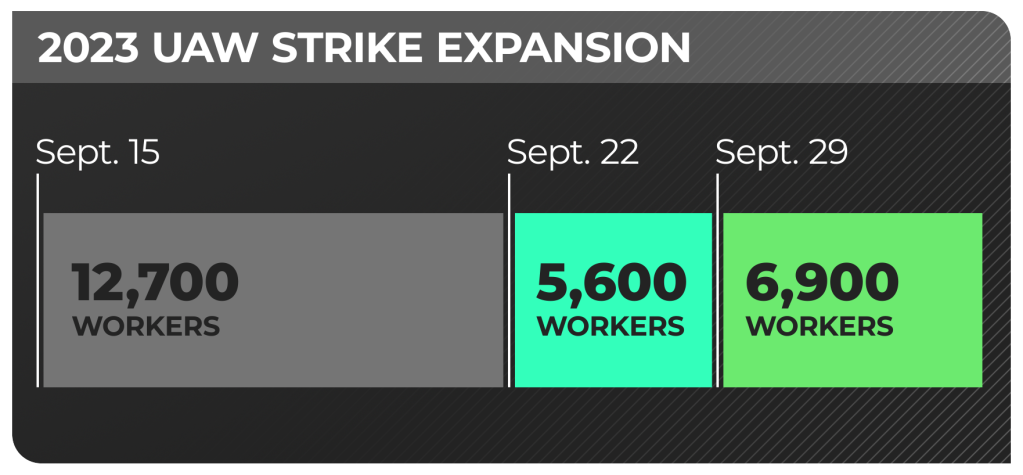

Manawar and AEG have been tracking those losses since the first day, when 12,700 UAW workers walked out of three plants in Michigan, Ohio and Missouri. Another 5,600 workers joined the strike in the second week, walking out of 38 distribution plants.

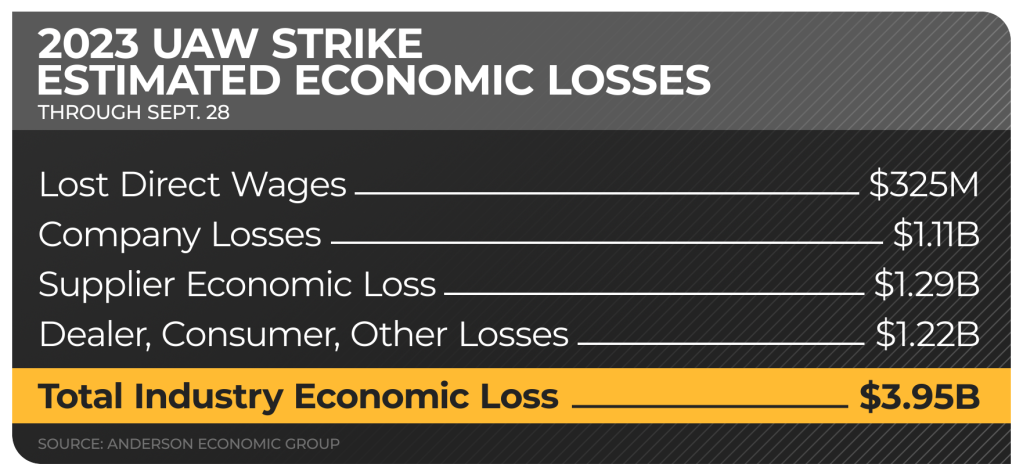

“First two weeks, we’re looking at $3.95 billion in economic losses. Third or fourth week might look different,” Manawar said.

Different means more expensive, as more plants and people are impacted each week as the strike expands. AEG’s latest figures don’t include week three, when 6,900 more workers walked out of Ford’s Chicago plant and GM’s Lansing, Michigan, plant.

“We do anticipate additional impact, not just on the manufacturers as well as suppliers, but also on consumers,” Manawar said. “Distribution centers are being either impacted or closed; workers are being laid off. That means the dealerships that not just rely on selling new cars, but also have different departments such as used and body shops, if they’re not able to get their job done, that is also impacting consumers directly.”

When UAW last went on strike in 2019 against GM, the 6-week stalemate pushed Michigan into a single-quarter recession.

“This time around, we are looking at not just Michigan, but also other states,” Manawar explained.

Meanwhile, GM is bracing for additional walkouts. The company said this week that it took out a $6 billion line of credit. On Wednesday, Oct. 4, GM announced the targeted strikes have already cost the company $200 million in the third quarter.

“I think [it’s] prudent in light of some of the messages that we’ve seen from some of the UAW leadership that they intend to drag this on for months,” GM CFO Paul Jacobson told CNBC.

Ford is presenting a more optimistic front, announcing its “seventh and strongest offer” to UAW, which includes immediate pay raises topping 20% and inflation protection down the road.

UAW President Shawn Fain plans to provide a strike update to the nearly 150,000 workers of the “Big Three” automakers on Friday, Oct. 6, according to Reuters.